A rate that does not cover the expenses incurred by the employee is not considered reasonable.

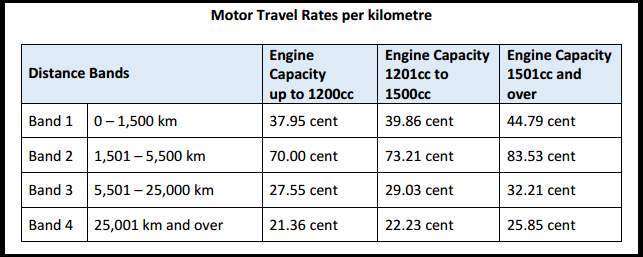

The type of vehicle and the driving conditions may also be taken into consideration in determining whether a given rate is reasonable. Car Provided by Employer: Taxable Value of Car Benefits Before YA 2020 If employer pays for the cost of petrol, use the rate of 0.55 per km instead of 0.45. Rates per kilometre, which may be used in determining the allowable deduction for business travel against an allowance or advance where actual costs are not claimed, are determined using the table to be published on this SARS website under Legal Counsel / Secondary Legislation / Income Tax Notices / 2023. Reasonable per-kilometre rateĪs a rule, the per-kilometre rate we consider reasonable is the rate that an employer subject to income tax can use to calculate the amount of the allowance they can deduct as a business expense under Québec tax laws and regulations.

#CENTS PER KM REIMBURSEMENT RATE 2022 FULL#

However, if the allowance is not reasonable, you must include the full amount of the allowance in boxes A, G, I and L of the employee's RL-1 slip (see courtesy translation RL-1-T). Therefore, if the allowance you pay an employee for the use of a motor vehicle is reasonable, it does not have to be included on the RL-1 slip, as this allowance is not taxable.

An allowance received by an employee for the use of a motor vehicle is taxable unless it is considered a reasonable allowance.Īn allowance is considered reasonable if the following conditions are met:

0 kommentar(er)

0 kommentar(er)